Financial Information

Selected Financial Information

Year Ended December 31

Highlights

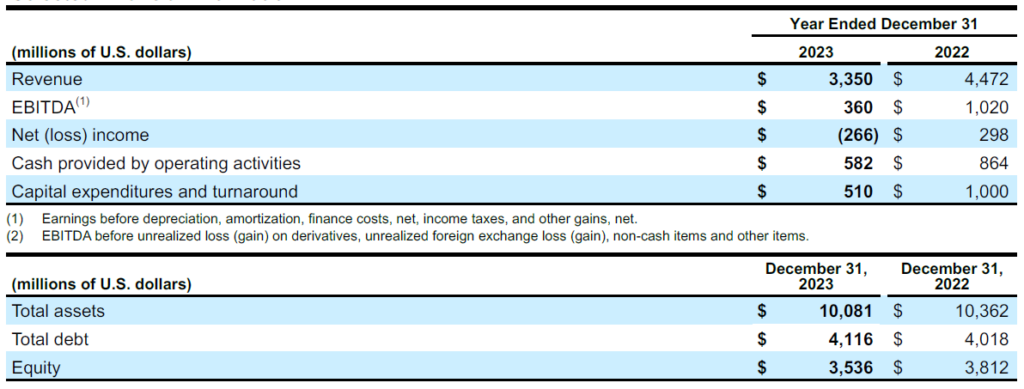

In 2023, NOVA Chemicals recognized total EBITDA of $360 million and net loss of $266 million compared to our 2022 EBITDA of $1,020 million and net income of $298 million. Numerous factors contributed to decreased earnings in 2023, including declining sales prices across the industry and our ethylene outages that limited our ethylene availability.

Despite the challenging market conditions experienced in 2023, we had several highlights throughout the year, including:

- In February 2023, we announced the establishment of NOVA Circular Solutions, a new line of business focusing on lower-emission, recycled solutions that will help reshape a better, more sustainable world. NOVA Circular Solutions will be home to the SYNDIGO™ brand, the Company’s newest portfolio of rPE.

- In March 2023, we announced our bold ESG aspirations to lead the plastics circular economy. Our Roadmap to Sustainability Leadership allows us to expand our sustainable product offerings, decarbonize assets, and build a state-of-the-art mechanical recycling business while exploring new advanced recycling technologies.

- In March and May 2023, we announced long-term virtual power purchase agreements to purchase renewable power and associated emissions offsets in Alberta, Canada.

- In July 2023, we announced an investment to develop our first mechanical recycling facility in Connersville, Indiana. The facility will process post-consumer plastic films to produce SYNDIGO recycled polyethylene and is expected to be operational in early 2025. Once fully operational, the facility is expected to produce over 100 million pounds of rPE annually and will be operated by NOVOLEX, a leading developer of packaging products for food service and industrial markets.

- We experienced unplanned outages at our Corunna ethylene unit in 2023. In parallel, we idled polyethylene production at our Moore and St. Clair facilities due to ethylene availability. We have successfully resumed production at our Corunna, Moore, and St. Clair facilities.

- In August 2023, we received our 2022 EcoVadis sustainability scorecard from our 2022 ESG report and were awarded a Silver rating. Our Silver rating places NOVA in the top 11 percent of companies assessed by EcoVadis in our industry category.

- In November 2023, Amcor a global leader in responsible packaging solutions and NOVA Chemicals announced agreement for Amcor to source Mechanically Recycled Polyethylene. Amcor will purchase SYNDIGO™ rPE resin, manufactured at NOVA’s first mechanical recycling facility in Connersville, Indiana, projected to be at commercial scale as early as 2025.

- In November 2023, we completed a private offering of $400 million, 8.50% senior secured first lien notes due 2028 and we redeemed an aggregate principal amount of $400 million of outstanding 4.875% senior unsecured notes due 2024.

- We continue to work through the start-up process of the AST2 facility at our Rokeby Site in Ontario, making progress towards commercial operations and sustained on-spec production of our broad portfolio of SCLAIR® and SURPASS® resins.

- Safe and reliable operations are foundational to our business and in 2023, we achieved a record TRCR of 0.13.

NOVA Chemicals Corporation (the “Company”) no longer makes its financial statements available to the general public. However, (1) holders of notes of the Company, (2) bona fide prospective investors who are either qualified institutional buyers or are non-US persons, (3) securities analysts, or (4) market makers in Company notes, can access Company information through the Company’s password-protected online data system. If you are included in any one of the above categories and wish to view Company information, please contact bondholder@novachem.com. Prior to providing log-in details, you may be asked to provide proof that you fall within one of the above categories and are entitled to access to the data site.

Contact Us

Investor inquiries, please contact:

Patty Masry

Leader, Financial Reporting & Investor Relations

Media inquiries, please contact:

Jennifer Nanz

Director, Communications