NOVA Chemicals Reports 2012 Fourth Quarter and Full Year Results

For immediate release, Friday, March 1, 2013, Calgary, Alberta, Canada

Strong Annual Earnings and Record Cash Generation Enabling Further Debt Reduction and Future Growth

2012 Results

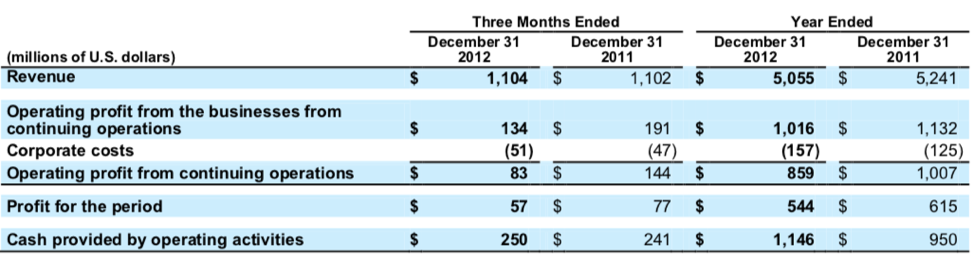

In the fourth quarter of 2012, we generated a profit of $57 million compared to a profit of $77 million in the fourth quarter of 2011. For the full year 2012, we generated a profit of $544 million compared to a profit of $615 million for the full year 2011. The quarter-over-quarter and year-over-year declines were primarily due to lower margins in our Olefins/Polyolefins business unit.

In the fourth quarter of 2012, our operating activities provided $250 million of cash, compared to $241 million in the fourth quarter of 2011. In 2012, our operating activities provided $1.15 billion of cash, compared to $950 million in 2011. The increases in cash were driven by continued strong earnings and a decrease in working capital.

The Olefins/Polyolefins business unit generated $133 million of operating profit in the fourth quarter of 2012 compared to operating profit of $190 million in the fourth quarter of 2011. For the full year 2012, the business unit generated operating profit of $1.0 billion compared to operating profit of $1.1 billion for the full year 2011. The quarter-over-quarter decline was due to lower margins in our Joffre Olefins segment offset somewhat by an increase in margins in our Corunna Olefins and Polyethylene segments. The year-over-year decline was primarily due to lower margins in our Joffre Olefins and Polyethylene segments offset somewhat by an increase in margins in our Corunna Olefins segment. The Performance Styrenics segment reported an operating profit from continuing operations of $1 million in each of the fourth quarters of 2012 and 2011. For the full year 2012, the segment generated an operating profit from continuing operations of $9 million compared to an operating profit from continuing operations of $7 million for the full year 2011. The year-over-year improvement was due to slightly higher margins.

Highlights

Since January 2012, we have used cash-on-hand to reduce our outstanding debt significantly. In particular, we repaid (i) our $400 million 6.5% notes; (ii) the outstanding balances on our accounts receivable securitization programs – which remain undrawn; and (iii) our $400 million floating rate notes, which were due in November 2013. In addition, we recently called early our $100 million 7.875% debentures due 2025, and intend to repay these debentures on March 15, 2013 using cash-on-hand. Including the planned repayment of the 2025 debentures later this month, we will have reduced our debt by more than $1 billion from in excess of $1.7 billion at the beginning of 2012 to approximately $700 million.

Financial Highlights

These highlights should be read in conjunction with our annual audited consolidated financial statements as of and for the year ended December 31, 2012 contained in our annual report on Form 20-F.

NOVA Chemicals’ 2012 annual audited consolidated financial statements and management’s discussion & analysis can be viewed on the Electronic Data Gathering Analysis and Retrieval System (EDGAR) at www.sec.gov/edgar.shtml or on NOVA Chemicals’ website at www.novachemicals.com.

NOVA Chemicals will host a conference call, Friday, March 1, 2013 at 11:30 a.m. ET (9:30 a.m. MT). The dial-in number for this call is (416) 406-6419 (passcode 4154451) and the replay number is (905) 694-9451 (passcode 4154451). The call is available on the internet at https://www.novachem.com/who-we-are/financial-information/.

Media and Investor inquiries, please contact:

Pace Markowitz, Director, Communications

Tel: 412.490.4952

E-mail: markowp@novachem.com

###

About NOVA Chemicals

NOVA Chemicals develops and manufactures chemicals, plastic resins and end-products that make everyday life safer, healthier and easier. Our employees work to ensure health, safety, security and environmental stewardship through our commitment to sustainability and Responsible Care®. NOVA Chemicals is a wholly owned subsidiary of International Petroleum Investment Company (“IPIC”) of the Emirate of Abu Dhabi, United Arab Emirates.

® is a registered trademark of NOVA Brands Ltd.; authorized use. Responsible Care is a registered trademark of the Chemistry Industry Association of Canada.

Forward-Looking Statements

This news release contains forward-looking statements regarding NOVA Chemicals’ plans to repay its $100 million 7.875% debentures due 2025 on March 15, 2013 using cash-on-hand. By their nature, forward-looking statements require NOVA Chemicals to make assumptions and are subject to inherent risks and uncertainties. Some of the risks that could affect NOVA Chemicals’ future results are detailed in the publicly filed disclosure documents and securities commissions’ reports of NOVA Chemicals. NOVA Chemicals’ forward-looking statements are expressly qualified in their entirety by this cautionary statement. In addition, the forward-looking statements are made only as of the date of this news release, and except as required by applicable law, NOVA Chemicals undertakes no obligation to publicly update the forward-looking statements to reflect new information, subsequent events or otherwise.