NOVA Chemicals Corporation Announces Early Tender Results of Cash Tender Offer for its 4.875% Senior Notes Due 2024

Calgary, AB (November 27, 2023) – NOVA Chemicals Corporation (“NOVA Chemicals”) announced today the early tender results of its previously announced offer to purchase for cash (the “Tender Offer”) up to $400.0 million in aggregate principal amount, the (“Aggregate Maximum Principal Amount”) of its 4.875% Senior Notes due 2024 (the “Notes”). The Tender Offer is being made in connection with a concurrent offering of notes by NOVA Chemicals sold in an offering (the “New Offering”) exempt from the registration requirements of the U.S. Securities Act of 1933, as amended. The Tender Offer will be financed by the amounts raised in the New Offering (net of transaction fees and expenses), and the Tender Offer is conditioned upon the satisfaction or, when applicable, waiver of certain conditions, which are more fully described in the Offer to Purchase, including the completion of the New Offering, on terms satisfactory to Nova Chemicals, raising proceeds sufficient to finance the Tender Offer (as further described in the Offer to Purchase, the “Financing Condition”).

The Tender Offer is being made pursuant to an Offer to Purchase, dated November 8, 2023 (as may be amended or supplemented from time to time, the “Offer to Purchase”).

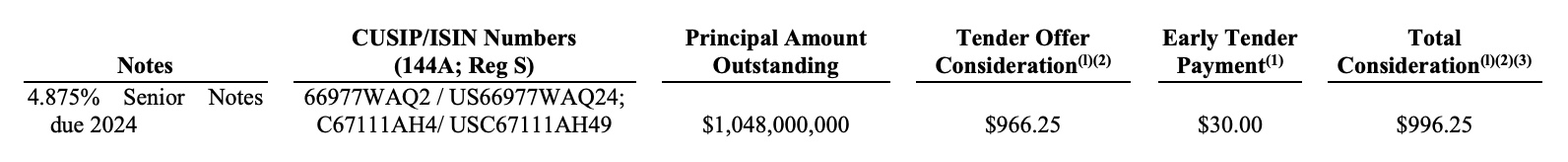

Certain information regarding the Notes and the terms of the Tender Offer is summarized in the table below.

(1) Per $1,000 principal amount of Notes accepted for purchase.

(2) Excludes Accrued Interest, which will be paid in addition to the Tender offer Consideration or the Total Consideration, as applicable

(3) Includes the applicable Early Tender Payment.

As of 5:00 PM, New York City time, on November 22, 2023, (such time and date, the “Early Tender Date”), according to information provided by Global Bondholder Services Corporation, the information and tender agent for the Tender Offer, an aggregate principal amount of $754,523,000 of the Notes had been validly tendered and not withdrawn in the Tender Offer for such Notes. Withdrawal rights for the Notes expired at 5:00 PM, New York City time, on November 22, 2023.

The Aggregate Maximum Principal Amount has been fully subscribed by the Notes tendered as of the Early Tender Date. In accordance with the Aggregate Maximum Principal Amount set forth above, the Notes validly tendered and not validly withdrawn prior to the Early Tender Date will be subject to proration as further described in the Offer to Purchase. NOVA Chemicals expects to accept for purchase an aggregate principal amount of $400 million of the Notes using a proration rate of 53.05%. NOVA Chemicals does not anticipate accepting for purchase any Notes validly tendered after the Early Tender Date.

The applicable Total Consideration (as set out in the table above) for each $1,000 of principal amount of the Notes validly tendered and not validly withdrawn and accepted for purchase is set forth in the table above. Only holders of the Notes who validly tendered and did not validly withdraw their Notes at or prior to the Early Tender Date are eligible to receive the applicable Total Consideration, which includes the Early Tender Payment for the Notes of $30.00 per $1,000 principal amount of Notes tendered. In addition, such Holders will also be entitled to receive accrued and unpaid interest, if any, from the last interest payment date for the Notes up to, but not including, the Early Settlement Date (as defined below).

It is anticipated that the settlement date for the Notes validly tendered and accepted for purchase will be November 28, 2023 (the “Early Settlement Date”).

NOVA Chemicals’ obligation to accept for purchase, and to pay for, Notes validly tendered and not validly withdrawn pursuant to the Tender Offer is conditioned upon the satisfaction or, when applicable, waiver of certain conditions, which are more fully described in the Offer to Purchase, including, among others, the Financing Condition. In addition, subject to applicable law, NOVA Chemicals reserves the right, in its sole discretion, to (i) extend, terminate or withdraw the Tender Offer at any time or (ii) otherwise amend the Tender Offer in any respect at any time and from time to time.NOVA Chemicals further reserves the right, in its sole discretion, not to accept any tenders of Notes. NOVA Chemicals is making the Tender Offer only in those jurisdictions where it is legal to do so.

RBC Capital Markets, LLC is acting as the sole dealer manager (the “Dealer Manager”) for the Tender Offer and can be contacted at ((Phone: +1 212 618 7843) (Toll Free: +1 877 381 2099)) with questions regarding the Tender Offer.

Simpson Thacher Bartlett LLP acted as lead counsel to NOVA Chemicals, with Osler, Hoskin & Harcourt LLP and Stewart McKelvey also acting for NOVA Chemicals. Latham & Watkins LLP acted as lead counsel to the Dealer Manager, with Torys LLP also acting for the Dealer Manager.

Copies of the Offer to Purchase are available to holders of Notes from Global Bondholder Services Corporation, the information and tender agent for the Tender Offer. Requests for copies of the Offer to Purchase should be directed to GBSC at (855) 654-2014 (toll free), (212) 430-3774 (banks and brokers) or contact@gbsc-usa.com.

Neither the Offer to Purchase nor any related documents have been filed with the U.S. Securities and Exchange Commission, nor have any such documents been filed with or reviewed by any federal, state, or foreign securities commission or regulatory authority. No such commission or authority has passed upon the fairness or merits of the Tender Offer or upon the accuracy or adequacy of the Offer to Purchase, and it is unlawful and may be a criminal offense to make any representation to the contrary.

The Tender Offer is being made solely on the terms and conditions set forth in the Offer to Purchase. Under no circumstances shall this press release constitute an offer to buy or the solicitation of an offer to sell the Notes or any other securities of NOVA Chemicals or any of its affiliates. The Tender Offer is not being made to, nor will NOVA Chemicals accept tenders of Notes from, holders in any jurisdiction in which the Tender Offer or the acceptance thereof would not be in compliance with the securities of blue sky laws of such jurisdiction. No recommendation is made as to whether holders should tender their Notes. Holders should carefully read the Offer to Purchase because it contains important information.

##

NOVA Chemicals Media Contact

Jennifer Nanz

Director, Corporate Communications

e-mail: jennifer.nanz@novachem.com

NOVA Chemicals Investor Relations

Patty Masry

Leader, Financial Reporting & Investor Relations

e-mail: Patty.Masry@novachem.com

###

The NOVA Chemicals logo is a registered trademark of NOVA Brands Ltd.; authorized use.

Responsible Care® is a registered trademark of the Chemistry Industry Association of Canada.

Certain statements included in this release are “forward-looking statements” within the meaning of the U.S. federal securities laws, including statements about the New Offering and the intended use of proceeds and the Tender Offer. All forward-looking statements involve risks and uncertainties which could affect our actual results and could cause our actual results to differ materially from those expressed in any forward-looking statements made by, or on behalf of, NOVA Chemicals. Further information regarding the important factors that could cause actual results to differ from projected results can be found in the Offer to Purchase.