White Paper: Inflection Point

Consumer research reveals opportunity to focus on impactful sustainability initiatives

March 31, 2021

Plastics have played a critical role in the COVID-19 pandemic, creating an inflection point for the industry. Many consumers are shifting their perceptions and behaviors to embrace the material’s value in delivering safety and convenience to their everyday lives.

Brand owners and retailers have an unprecedented opportunity to build upon this consumer receptiveness with messaging that will resonate and packaging products that will meet a real, rather than perceived, sustainability need.

According to research by NOVA Chemicals, the consumer of 2020 is substantially different from the consumer of 2019 on four fronts – safety and sanitization, perception, e-commerce, and recycling.

Putting Safety First

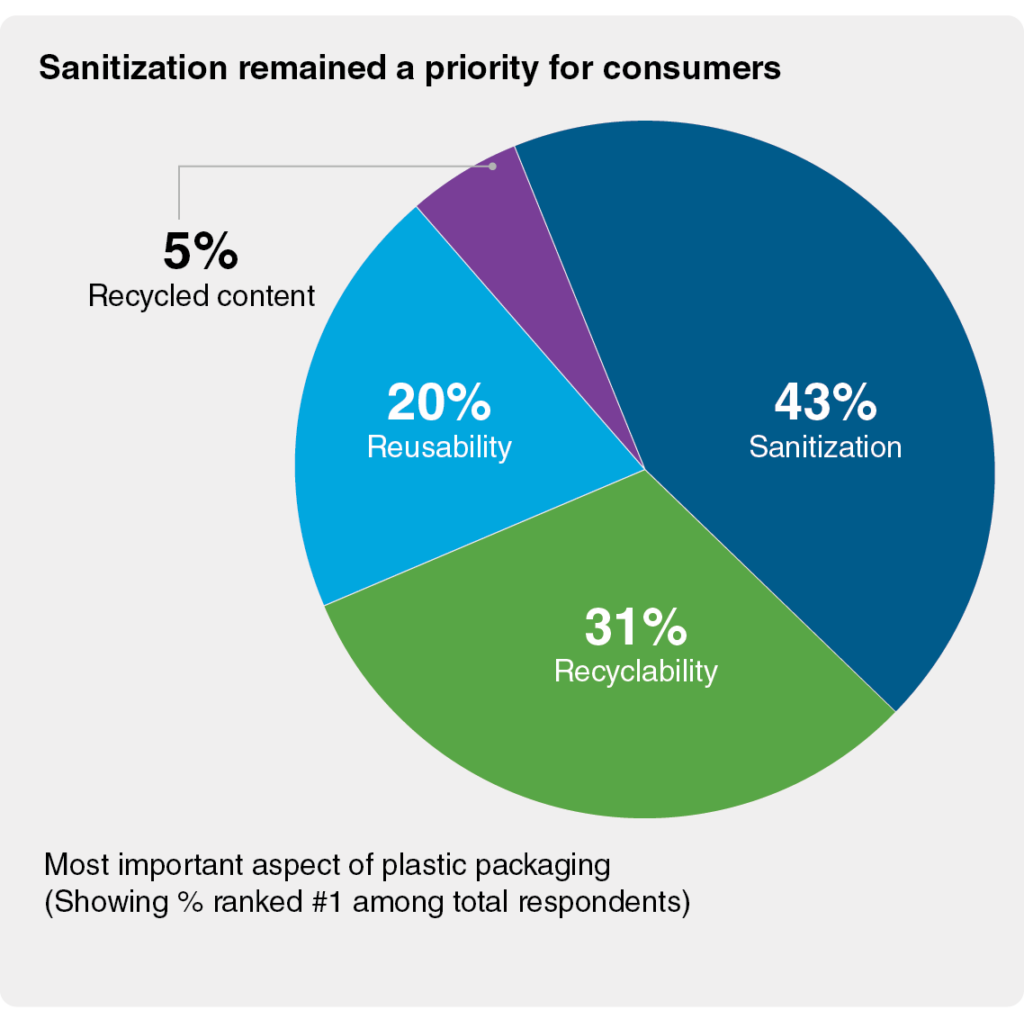

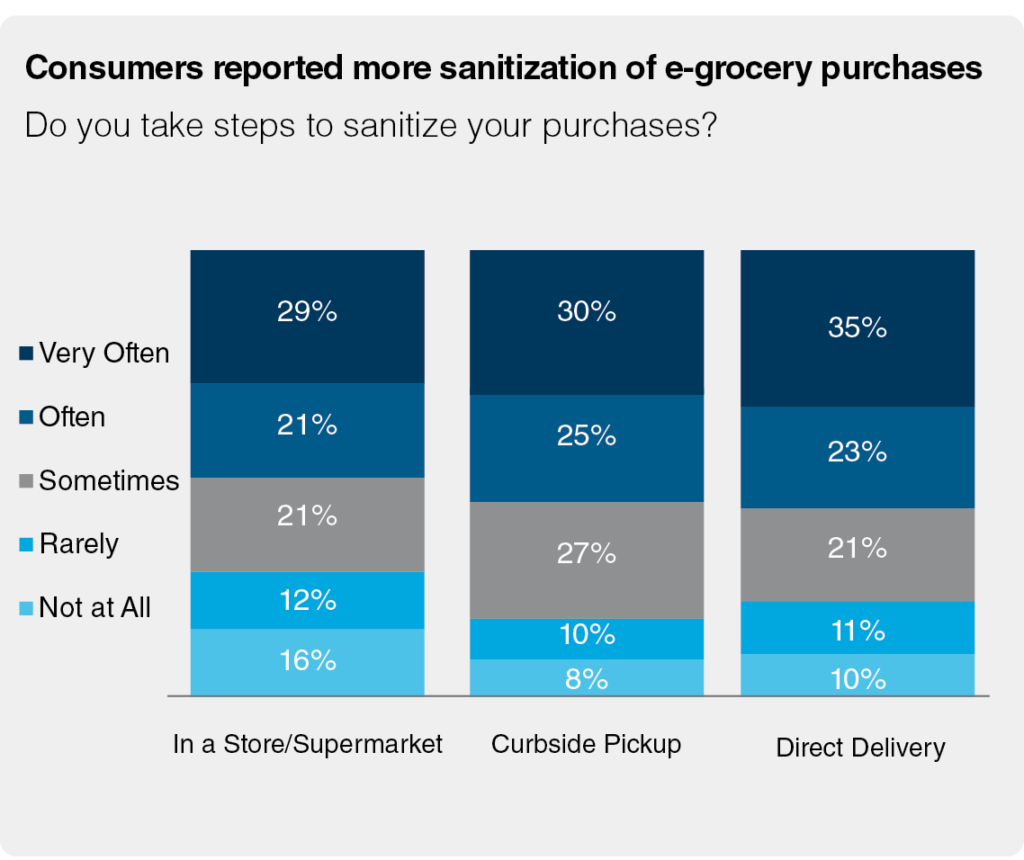

Food safety has always been a concern and the pandemic has heightened awareness of – and reliance on – the ability of plastics to provide a barrier between product and people. According to surveyed consumers, sanitization is the most important aspect of plastic packaging.

Nowhere is this more critical and evident than with produce and prepared foods. These items have shifted toward individual packaging to address sanitization and safety, and support e-commerce needs.

For brand owners and retailers, the “rise of touchless” creates opportunities to differentiate their products through packaging. Features such as tamper resistance, easy opening, reclosability and eye-catching graphics will draw consumers in, and messaging highlighting the value of plastic’s safety and sanitization will help build brand loyalty.

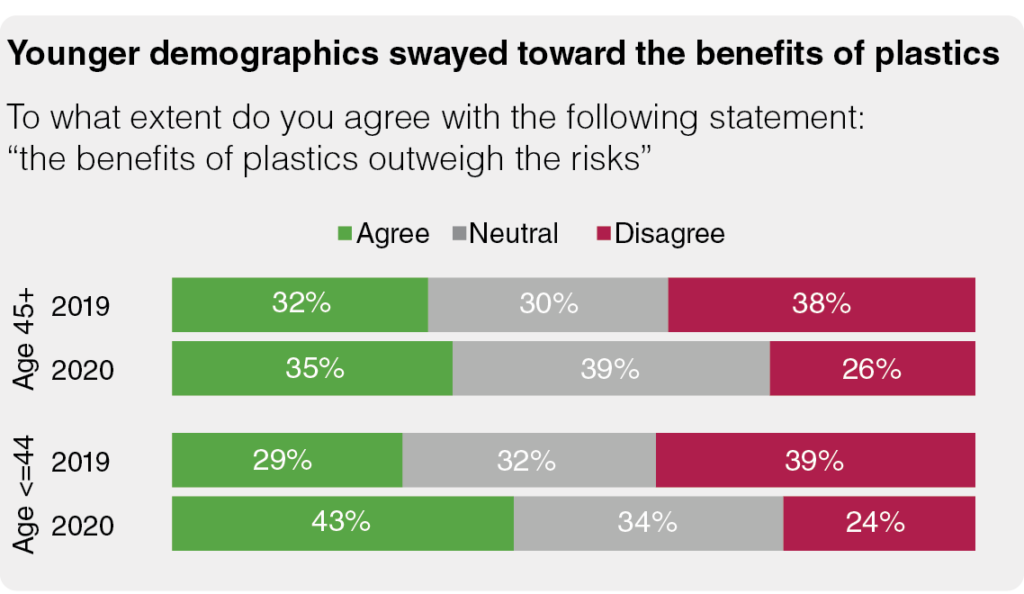

Looking across all demographics, perceptions have improved. Only about 30% of each felt the benefits of plastics outweighed the risks in 2019 compared to close to 40% on average among all respondents in 2020. This dramatic shift opens the door for brand owners and retailers to move from defending the use of plastics to promoting their value in keeping people and products safe.

Increased consumer receptiveness to plastics also presents an opportunity to make improvements that are truly more sustainable rather than simply a way to respond to consumer misconceptions. Recent data shows that the majority of consumers don’t have an issue with using plastic; the industry has an opportunity to reinforce the value of plastics and focus on solving the real problem – management of post-use plastics.

Shifting Perceptions

In one of the most profound findings, the perception of plastics significantly improved between 2019 and 2020.

The largest shift was among younger consumers (age 44 and under), where those who stated they agree with the statement “the benefits of plastics outweigh the risks” jumped 14 percentage points. In typical year over year market research with a similar sample size, a change of 5 percent or more would be considered statistically significant.

Consumers over age 44 had a slight increase in agreement, moving from 32% in 2019 to 35% in 2020. What is more significant with this demographic is the increase in those who were neutral (30% to 39%). People who fall into the neutral category can be swayed to positive and rarely shift toward negative.

Younger generations typically are more fluid in their views, which could help explain the larger jump in agreement. Older consumers tend to be more entrenched, and they also have used other packaging materials, such as glass and metal, for a much longer time.

Going Shopping – Online

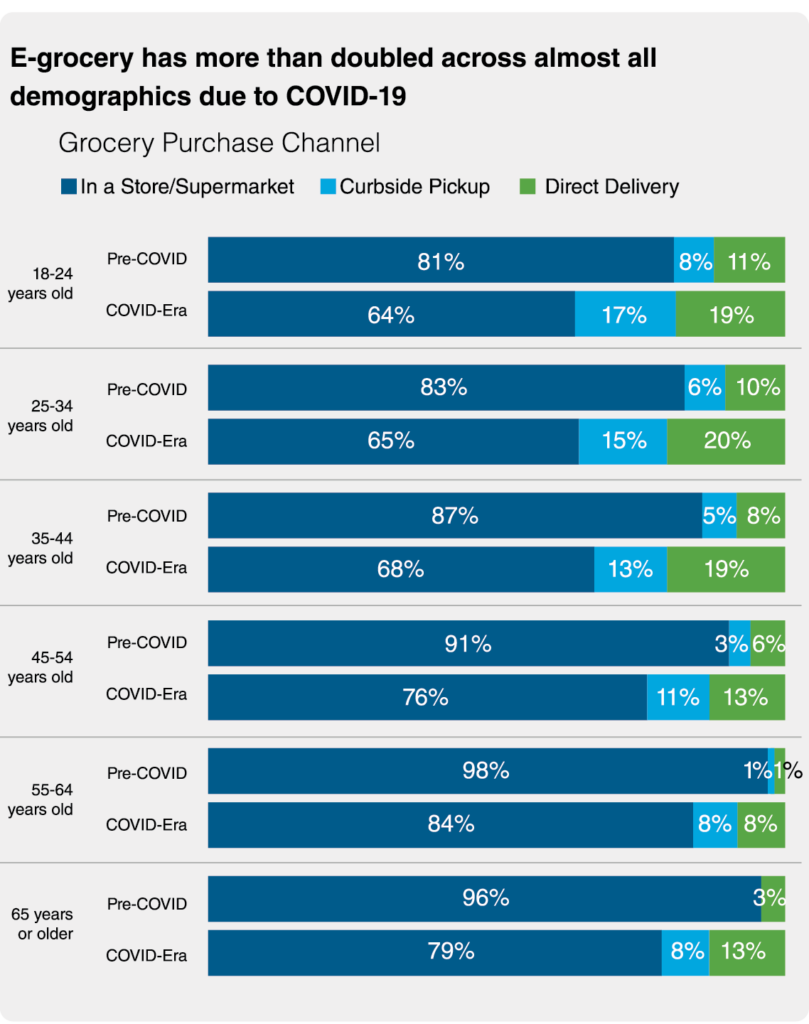

As the pandemic emptied grocery shelves and raised concerns about in-person shopping, e-grocery doubled across every demographic surveyed. Consumers who previously had not adopted online shopping suddenly saw it as a necessity, with their perceptions changing now that this barrier to entry was unexpectedly removed.

According to NOVA Chemicals data, the biggest shift came with consumers age 65 and older. Before the pandemic, only 3% of grocery purchases by seniors were through curbside pickup or direct delivery. In one year, that jumped to 21%.

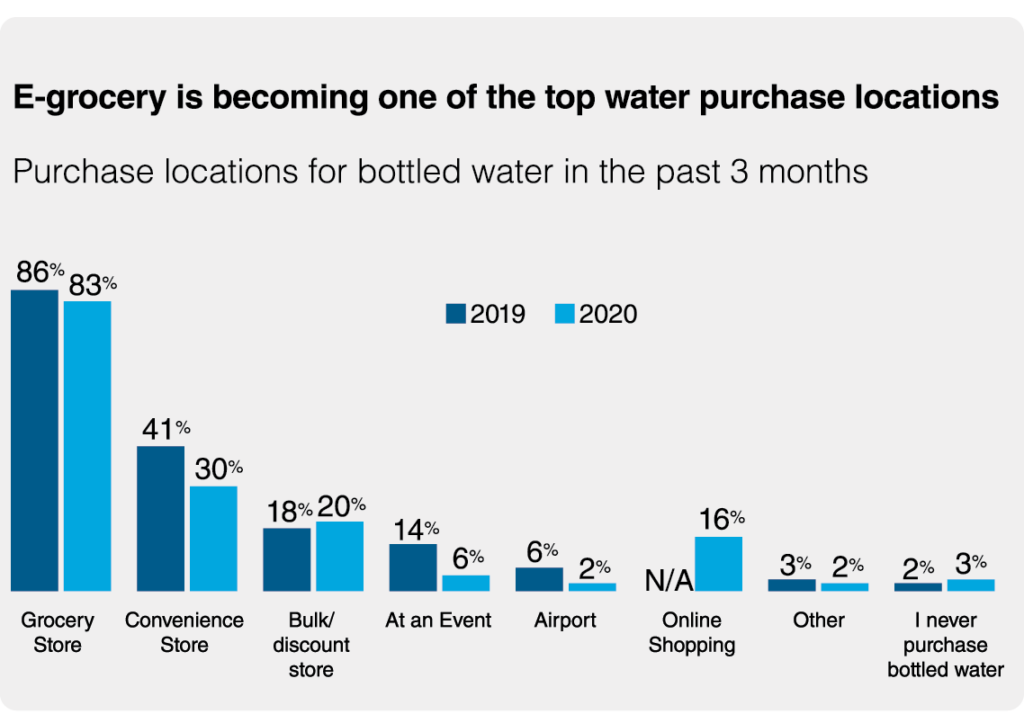

What consumers are buying online also has evolved. Reductions in bottled water purchases from convenience stores, airports, and events was more than offset by e-retailers. In the pandemic era, 16% of bottled water consumers reported purchasing water online. Other household goods normally purchased in-store, such as personal care products, detergent and milk, are also ending up in online shopping carts.

In this growing e-commerce world, packaging must perform at a higher level so consumer adoption is sustained or improved. Packaging once designed for a store shelf now must withstand the rigors of shipping and handling, provide an aesthetically pleasing and frustration-free consumer experience, and be “right sized” to eliminate the cost, bulk and waste of additional packaging. In the words of Amazon, it should delight the consumer.

“e-commerce packaging … should delight the customer”

Filling the Recycling Bin

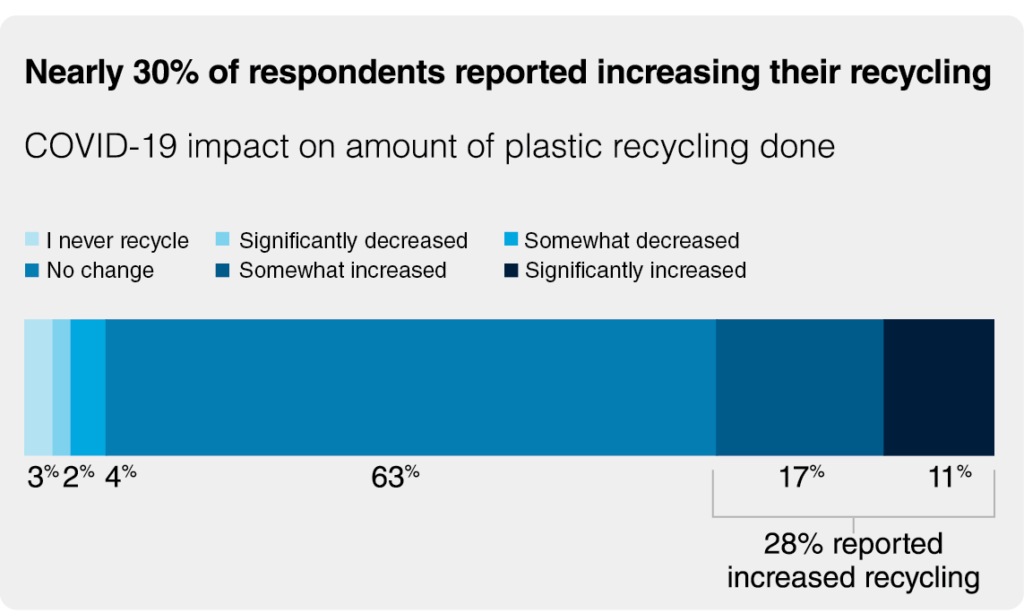

Because consumers are staying home more during the pandemic, their recycling habits improved significantly. Nearly 30% of survey respondents indicated they increased the amount of plastic they recycled in 2020.

This is good news for an industry dealing with chronic shortages of high-quality post-consumer resin (PCR), which is needed to fully close the loop in the circular economy. Much rigid plastic packaging has been curbside recyclable for some time. As more flexible packaging migrates to recyclable film structures, we can capture the value of even more post-use plastics again and again.

Access to PCR is just part of the equation. Consumers’ heightened awareness about recycling needs to be sustained post-pandemic with easy out-of-home recycling access, and there must be more investment in recycling capabilities and infrastructure to accommodate greater circularity.

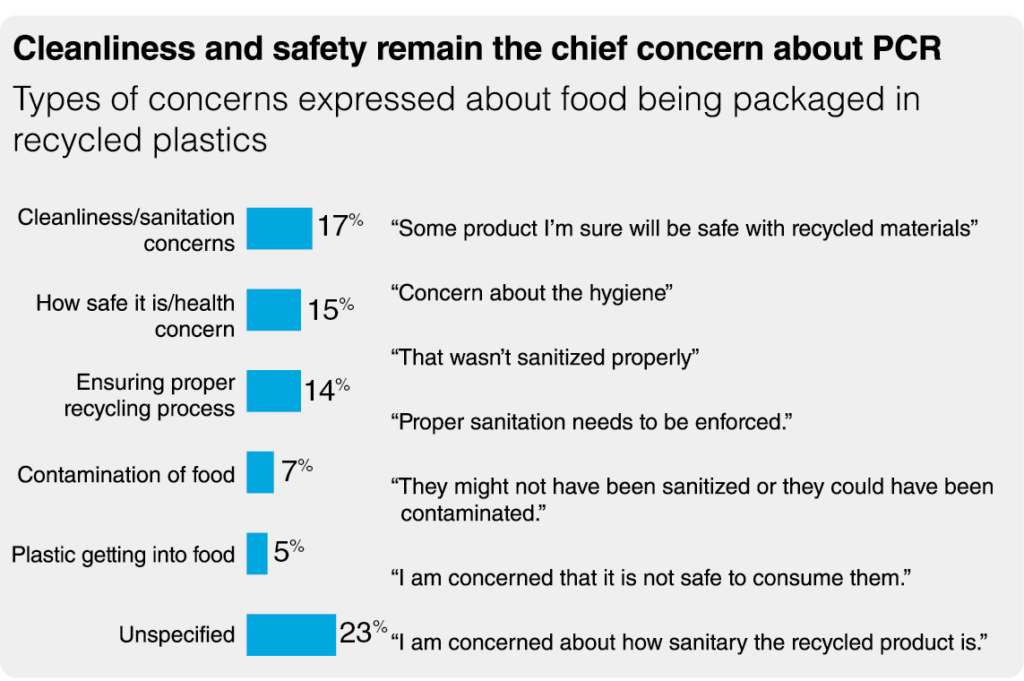

While recycling rose in 2020, purchasing products made from PCR fell in importance significantly among those surveyed with incomes from $10,000 – $100,000, which makes up 75% of households polled.

However, concern about the cleanliness and safety of recycled content in food-contact applications declined slightly, demonstrating that consumer confidence in these products may be increasing.

To continue to alleviate concerns at a time when recycled content in packaging is poised to grow, the industry must step up education and awareness efforts to replace consumer perceptions with the realities of recycled content. Highlighting packaging wins, where recycled content has been used successfully, will support the effort and help alleviate consumer uncertainty.

Moving Forward

In one year, the plastic packaging industry experienced a seismic shift in consumer perceptions and behaviors:

- Consumer perceptions of plastic improved across all demographics, but most dramatically among young people.

- E-commerce growth exploded. Consumers are experiencing packaging differently and have new expectations around convenience and product protection.

- Recycling saw renewed vigor – related to newly home-based lifestyles – while recycled content declined in importance.

- Safety and sanitation are at the forefront of our lives right now. This is reflected in how we handled our food and the temporary dip in sustainability focus.

However, the root problems persist. Plastics have no place in the environment, and they are too valuable to end up as waste.

It is imperative that brand owners and retailers build upon this receptive environment by promoting the value of plastics and being realistic and transparent in their commitment to sustainable packaging.

The NOVA Chemicals survey was conducted in July 2019 and August 2020 by GLG. Sample sizes were 1,209 in 2019 and 1,280 in 2020 with matched demographics.